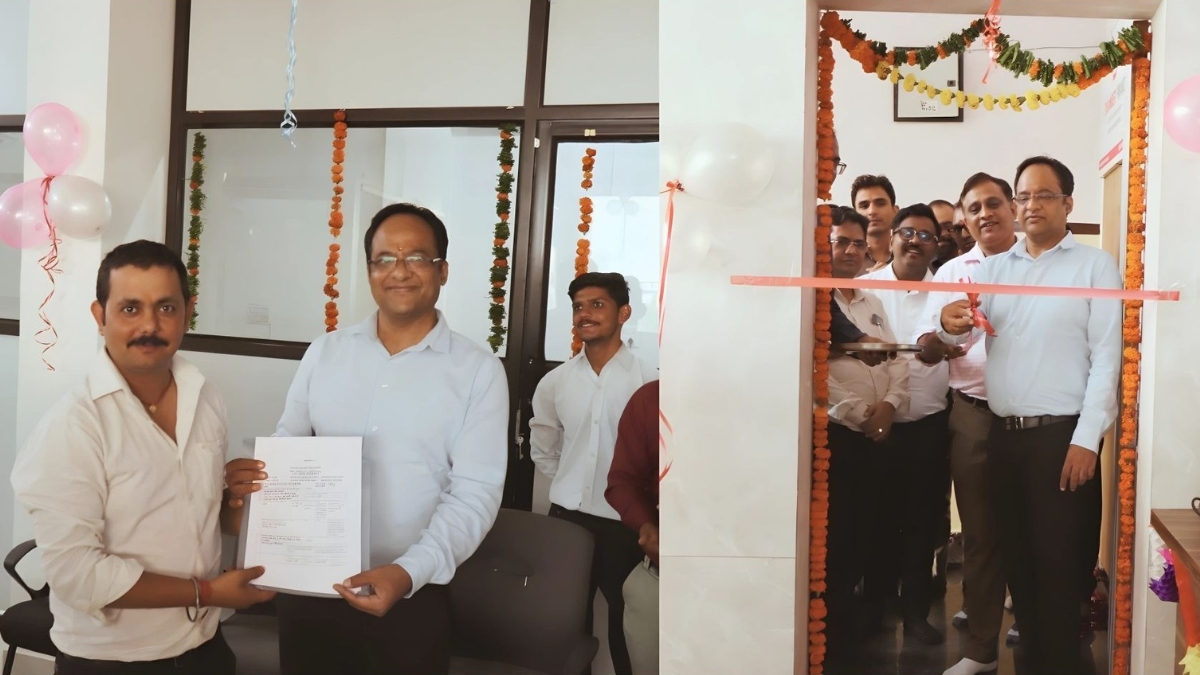

New Delhi [India], September 3: Digamber Capfin Limited) (Digamber Finance), One of India’s leading NBFC-MFIs announced a strategic move into the small business loan category with plans to launch dedicated services across 10 states in FY 2025–26, starting with the opening of its first Small Business Loan Branch in Jaipur, Rajasthan. This initiative marks a significant diversification beyond microfinance, with the company introducing a comprehensive suite of small business loans and financial product distribution solutions tailored for micro and small entrepreneurs, shopkeepers, hawkers, and street vendors.

Speaking on the announcement, Amit Jain, Promoter & Whole-Time Director, Digamber Capfin Limited, said: “Small entrepreneurs and local businesses are the real drivers of India’s economy, yet they face the toughest barriers to accessing credit. Through our Small Business Loan Branch model, we aim to bridge this gap by providing affordable finance and digital-first services. This initiative is not just about lending—it’s about empowering millions of livelihoods, supporting inclusive growth, and contributing to the national vision of Viksit Bharat 2047.”

This initiative comes at a time when India’s MSME sector—contributing nearly 30 per cent to GDP and employing over 110 million people—still faces a massive credit gap of about $240 billion. With only 16 per cent of bank credit reaching this segment, small entrepreneurs are often left to depend on informal sources. For Digamber Finance, this model represents an extension of its business approach—evolving from Joint Liability Group (JLG)-based microfinance to also offering individual loans designed specifically for small businesses. By doing so, the company seeks to unlock credit access for entrepreneurs who require larger, more flexible, and tailored financing options. Its Small Business Loan Branch model combines lending, financial product distribution, and technology-enabled efficiency through its Bengaluru IT hub, strengthening entrepreneurial growth in line with the vision of Viksit Bharat 2047.

Building on its existing presence across eight states and one Union Territory with more than 200 branches, Digamber Finance will now replicate this model across 10 states during FY 2025–26. The company’s current AUM stands at ~₹700 crore and it employs over 1700 people. With the launch of this new vertical, Digamber Finance will expand its workforce significantly. In a first-of-its-kind model for the NBFCs, the company will hire about 200–250 new human resources across these states in a work-from-home format, with employees digitally reporting into the respective Small Business Loan branches and Digamber Finance Head Office. This innovative model is expected to enhance reach, reduce overhead costs, and ensure seamless servicing of clients spread across wide geographies. With these efforts, Digamber Finance anticipates its AUM to grow by ~20% percent in FY25–26, adding approximately ~₹150 crore to its portfolio.

Over the coming years, Digamber Finance intends to deepen its presence in underserved markets, broaden its product portfolio, and emerge as a long-term partner for India’s micro and small business ecosystem. The company remains committed to sustainability, digital innovation, and financial inclusion, ensuring that its growth translates into lasting impact for entrepreneurs and communities alike.

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.